Assembly cannot provide any tax advice. Tax laws vary by country, state, entity type, industry, location and we recommend consulting your tax professional for specifics on your accounting treatment.

This document is for informational purposes and should not be relied on for legal, accounting or tax advice.

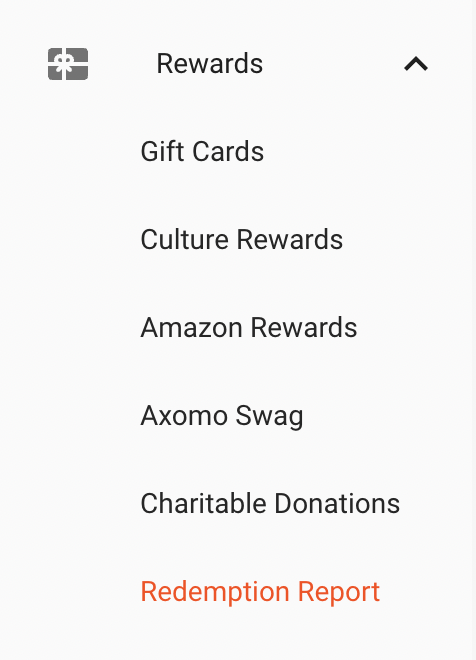

Although we are not able to provide tax advice, we do want to make taxes as easy as possible for your team! Assembly provides a tax report that can be found in Admin within the Rewards > Redemption Report page:

No matter what type of company you are a part of, this report can be downloaded daily, weekly, monthly quarterly or annually depending on your tax schedule.

Some companies treat rewards as taxable, some companies do not, some companies treat the rewards as non taxable until a certain amount. Speaking broadly, any reward given from an employer to an employee are taxable. However, there are exceptions:

De Minimis Awards: This type of award is defined by the IRS in Publication 5137 as: “A prize or award that is not cash or cash equivalent, of nominal value and provided infrequently.

Employee Achievement Awards: These are non-cash awards specifically related to either length of service or safety. These are awards under a formal plan that meets the specific criteria outlined by the IRS.

Charitable Donations: Employees can have the option to give their earned points”money” to charity which has different implications.

Consult Your Tax Professional: They can advise on your specific situation.

Check Company Policy: Ask how your company handles taxes on rewards.

Be Aware of "True Up": Many companies pay the taxes on rewards for their employees.

Tax Reporting Schedule: Varies (monthly, quarterly, annually) based on company factors.

True Up Process: Consider implementing to avoid employee tax burden.

Check Assembly's Redemption Report in your Admin section.

Consult your company's HR or finance department.

Speak with a tax professional for personalized advice.

Check-out the IRS' FAQ on gift taxing.

Remember, Assembly is here to make rewards easy and enjoyable. While we can't offer tax advice, we're always working to simplify the process for you!